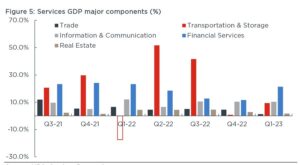

FRI, JULY 07 2023-theGBJournal | Despite the base-effects induced slowdown in the Services sector (+4.35% y/y vs Q4-22: +5.69% y/y), the sector remains the main broad driver of the economy.

The preceding is underpinned by sustained growth in the financial & insurance and ICT sectors amid slow growth in the trade subsector.

Notably, the financial and insurance subsector grew significantly by 21.4% y/y (vs +11.6% y/y in Q4-22) against the backdrop of the increased e-banking transactions consummated in the review period due to the CBN’s currency redesign drive.

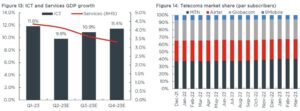

In the same vein, the ICT sector maintained its sturdy growth in Q1-23, supported by the twin impact of increased subscribers and higher data traffic influenced by the increased adoption of electronic payments in the review period.

For instance, MTN Nigeria’s (c.40.5% market share as of March 2023) subscriber base grew to its highest level (76.70 million subscribers) since the commencement of operations in 2001 and recorded 50.3% y/y growth in data traffic in Q1-23.

On the flip side, the slow growth recorded in the trade sector (+1.31% y/y) was driven by the informal sector’s inability to access adequate cash to drive sales in the period.

We expect the ICT subsector to also maintain its growth trend over 2023FY, buoyed by solid voice and data traffic growth across telecommunications companies.

Most recently, telco’s Payments Service Banks (PSBs) have gained traction, given the increasing need for digital banking platforms. For context, MTNN’s PSB (MOMO) active wallet rose to 3.2 million in Q1-23 (Q4-22: 2.0 million).

Additionally, we believe the sustained rollout and adoption of 4G and 5G networks will support the telecommunication subsector’s growth in the short-to medium term. Nonetheless, we see a potential risk of higher taxes in the telecommunication sector in line with the 2023 Fiscal Policy Measures (FPM).

Notably, the government imposed a 5.0% excise duty on mobile telephone services (GSM), fixed telephone and internet services, both post-paid and prepaid. But the Federal Government realised the potential risks of the policy and President Bola Ahmed Tinubu has since signed into law a bill reversing the decision.

Elsewhere, we expect improved private spending on capital projects to generate a positive spillover effect in the real estate subsector, particularly as the initial election uncertainties have faded.

At the same time, we believe the smoothening out of cash shortages should buoy the trade sector’s performance.

Also, we believe low consumer disposable income, high cost of building materials, and low public spending on capital projects pose downside risks to the real estate, cement and construction subsectors.

Overall, we now expect the Services GDP to grow by 3.83% y/y (vs +6.66% y/y in 2022FY) amid the high statistical base effects from the prior year. Outlook Analysis is provided by Cordros Research

Twitter-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com| govandbusinessj@gmail.com