… Grab accounts for 46%

WED SEPT 16, 2020-theGBJournal-Ten highest funded private Fintech companies have cumulatively raised $20.92 billion, as Fintech companies continue to enjoy a deluge of funding in the last few years.

The registered funding is as of September 2020, according to data presented by Buy Shares and Grab, South East Asia’s leading mobile and wallet remittance company accounts for almost half of the funding.

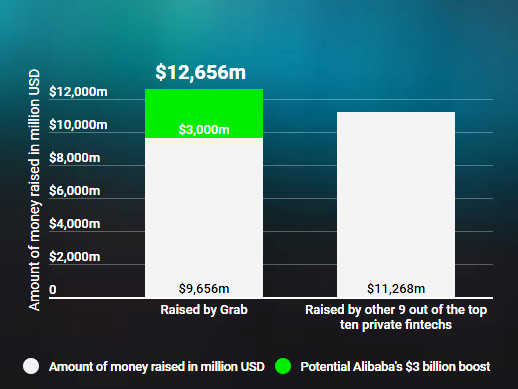

Grab has the highest share at $9.65 billion or 46% of the top ten most funded companies. Stripe’s $1.95 billion is almost five times less than Grab’s to lie in the second spot.

Robinhood has raised the third-highest amount at $1.71 billion followed by Oscar Health’s $1.49 billion. Digital banking platform Nubank closes the top five categories having raised $1.39 billion to date.

Cryptocurrency exchange Coinbase has raised $538.70 million, the least in the group. BlueVine is ninth with $691.1 million, making it the other only company with less than one billion in funding.

With a rise in the Fintech sector funding, new trends are beginning to emerge in the sector. According to the research report:

“Due to economic uncertainties like the coronavirus, new trends in Fintech funding are beginning to emerge. Most investors are moving money away from seed and early-stages toward late stages as a safety measure. Additionally, investors are betting on firms that improve existing processes,” says Buy Share.

As the Fintech sector continues to evolve, investors are taking advantage of the emerging opportunities brought about by factors like technological innovations.

Despite the huge funding among Fintech companies, they face a unique set of challenges to expand across borders. Notably, the financial industry is one of the most regulated in the world, with different tax, labor, and reporting regulations.

Some of the countries with thriving Fintech companies are on board making it easier for Fintechs to operate on a large scale. However, they still face other complex challenges, like limited resources to scale quickly and survive. Due to the unique set of challenges, some companies choose to scale international expansion by forming partnerships with established players, rather than competing against them. For example Grab’s contention to partner with Alibaba.

Although the funds raised by Fintech is significantly high, funding has dropped in recent years. Fintech startups faced competitions after traditional players like banks started their own fintech operations. Investors have also been skeptical to join the Fintech sectors due to security issues. The sector deals with sensitive information becoming more susceptible to security breaches. This is one of the main factors fueling skeptics to rely on fintech companies.

In general, the Fintech sector funding is expected to grow fueled by new technologies that keep emerging. For example, artificial intelligence and cyber defenses are leading to innovations in the industry hence attracting investors who see potential. The rise of alternative funding is also expected to grow more roots in the Fintech sector. Alternative finance like peer-to-peer lending and invoice trading allows people to lend or invest through online platforms.

The transformation of the financial services industry through Fintech is still ongoing. The sector is maturing, with fewer but larger and later-stage deals being finalized. Overall, Fintech growth will ultimately create outsized opportunities for firms and help empower them.

Twitter-@theGBJournal|email: info@govandbusinessjournal.com.ng